Conversational AI in FINANCIAL SERVICESTurn transactions into trust

Transform the banking experience with digital conversations. Bring efficiency, security, and personalization to every transaction with the help of AI.

Get started with the guideGet a demoTrusted by thousands of financial services leaders

Conversations that drive results

Financial services brands using conversational AI solutions have seen:

4x

increase in converted sales

20%

increase in consumer satisfaction

50%

decrease in cost of care

Want to see the results for your business? Try our ROI calculator.

CONVERSATIONAL AI USE CASES FOR FINANCIAL SERVICES

It’s not about the AI, it’s about the account holder

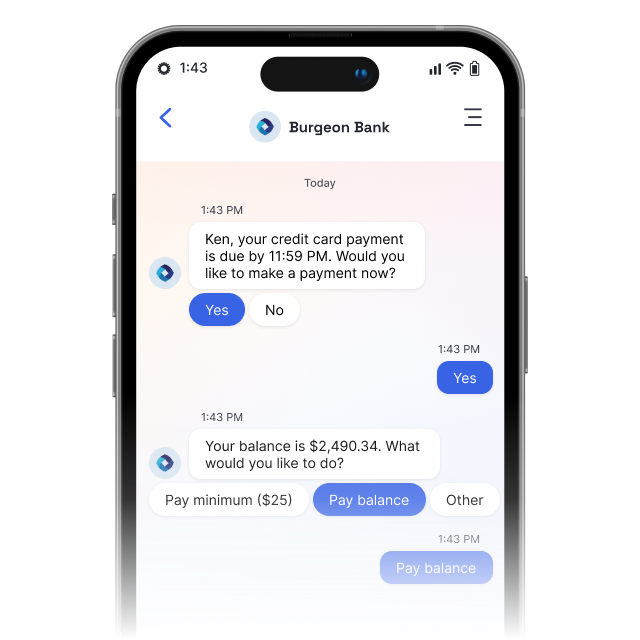

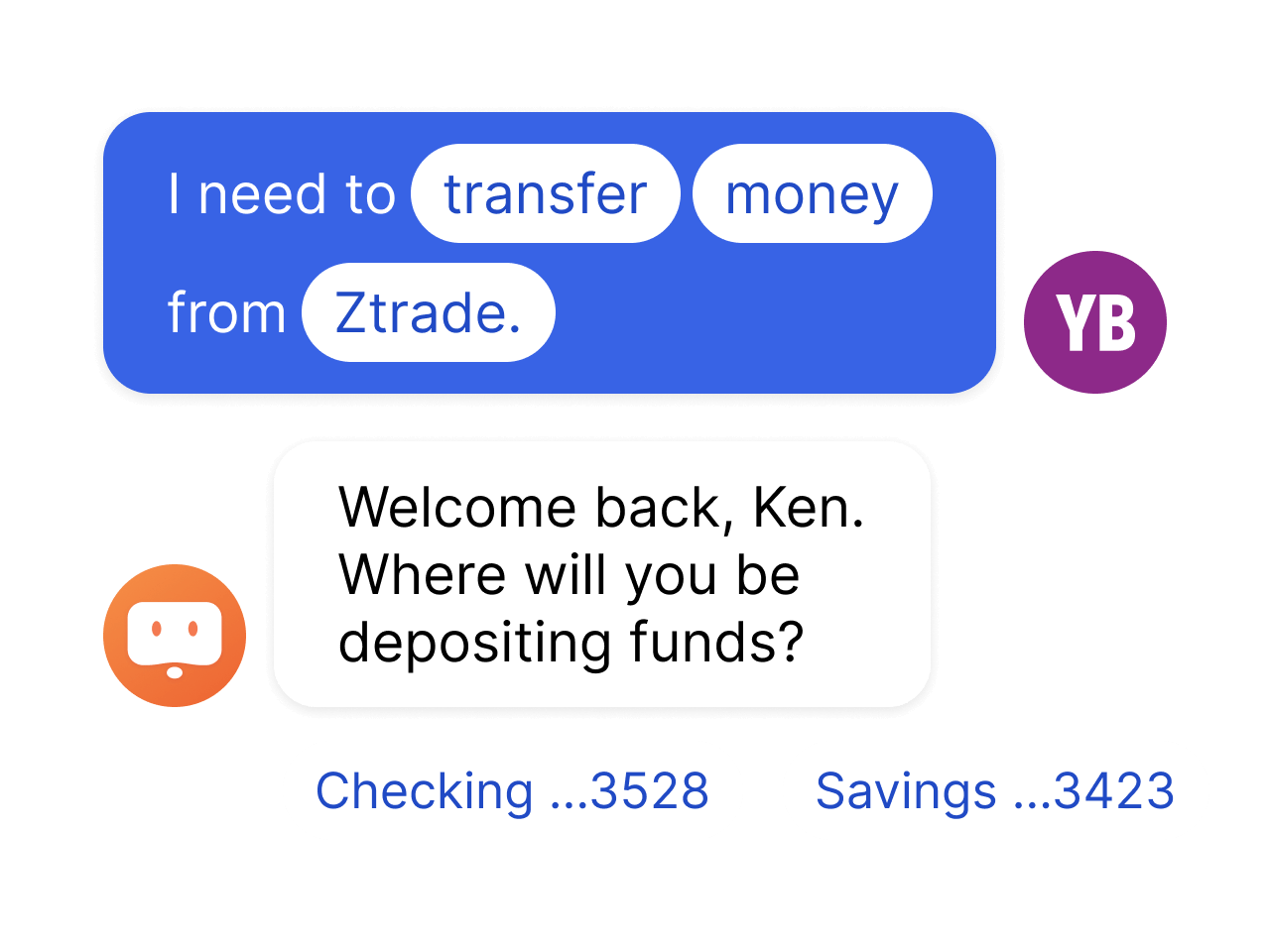

Make it easy to self service common support requests like autopay, canceling payments, and checking account balances.

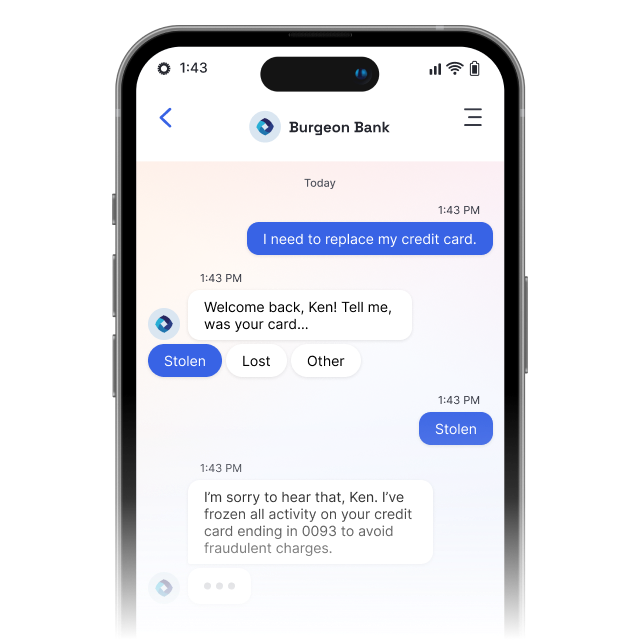

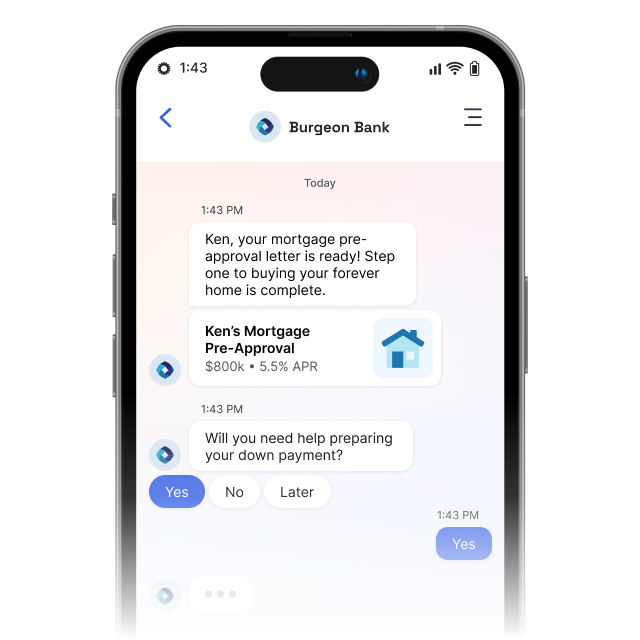

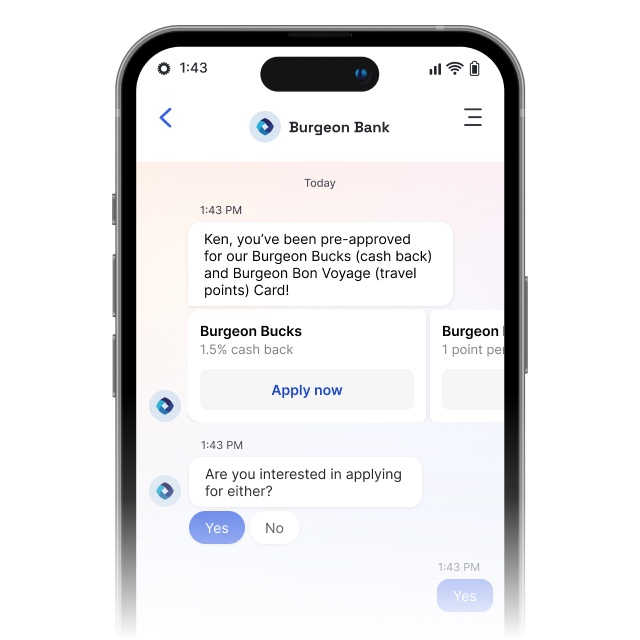

Give clients the power to replace a card, merge or cancel accounts, check credit scores, and more with conversational banking.

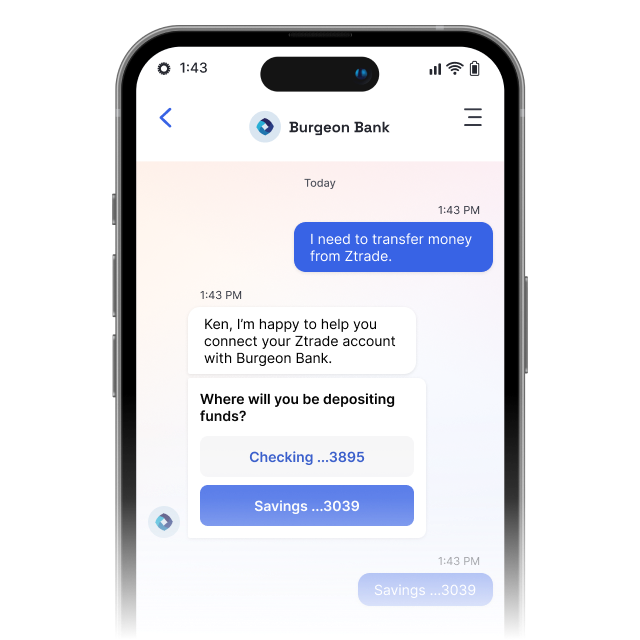

Allow clients to resolve issues, even after hours. Provide round-the-clock support for login issues, bank transfers, and pin resets.

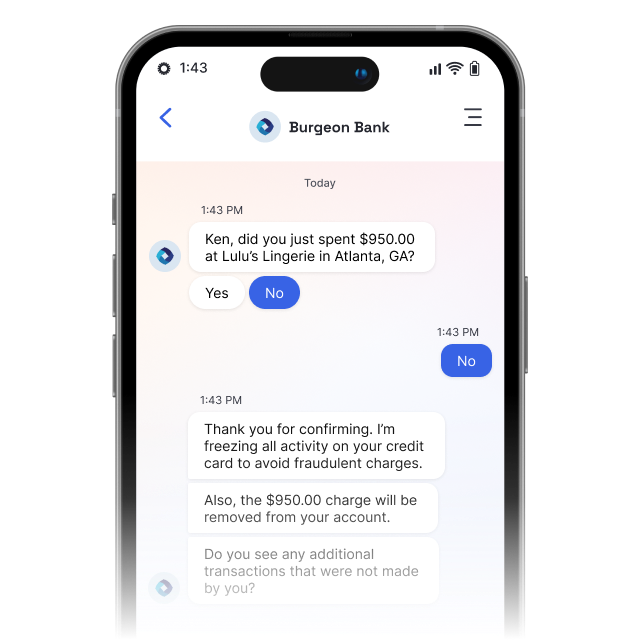

Compromised accounts are stressful. Conversational banking bots handle the critical information collection, then escalate to an agent for personal support.

Take the stress out of applying for a loan by streamlining the approval process with automation.

Stay connected to customers with promotional offers and discounts using Proactive Messaging.

Digital transformation guide

Build your conversational banking strategy

Move beyond traditional customer service barriers. Try these strategies to make banking with your financial institution a smoother experience.

Banking industry solutions that put clients first

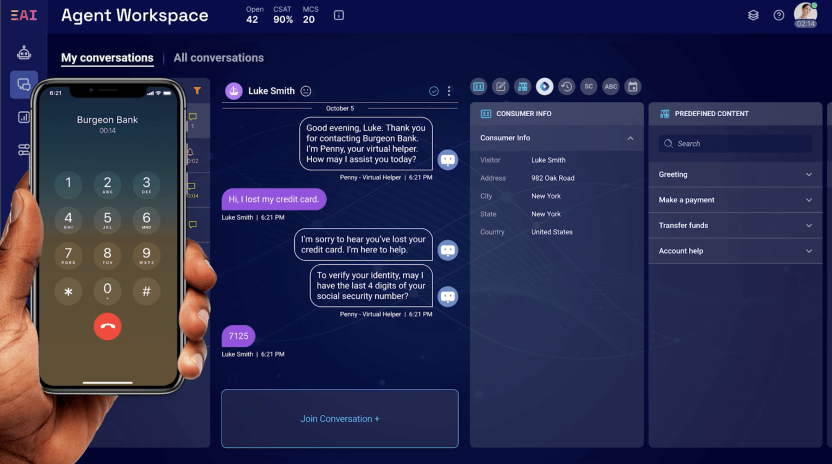

Conversational intelligence + agent tools

Empower your agents

Equip your team with conversational banking tools to deliver personalized advice, guide investment choices, and connect with clients when it matters most.

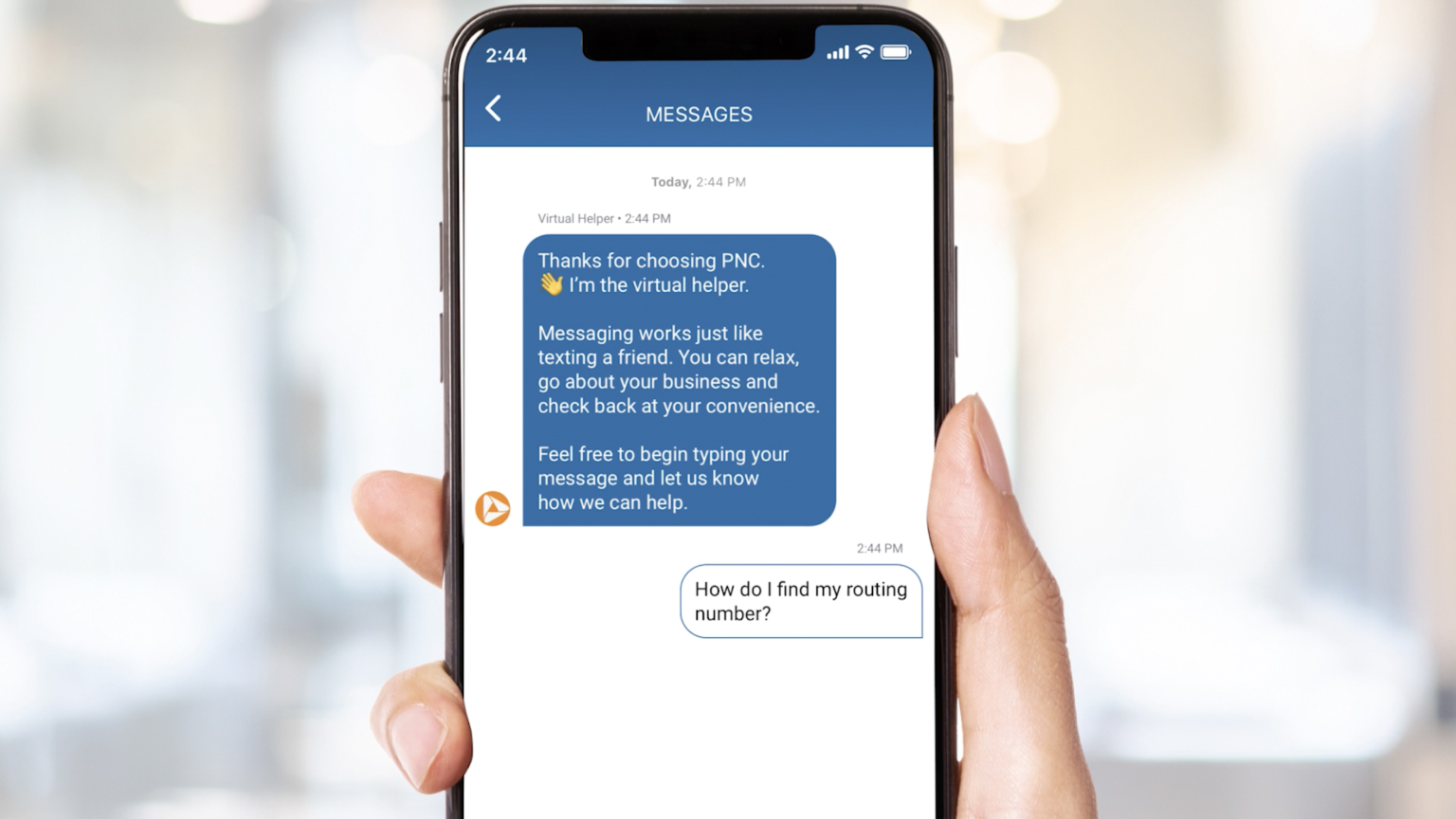

All the channels

Shift to digital

Redirect clients from hold lines to messaging apps they use daily. Unlock new banking experiences and opportunities for engagement and growth.

Platform + integrations

Embrace automation

Use LLM-powered AI to automate common customer intents like balance inquiries, transfers, and fraud alerts, enhancing efficiency and customer satisfaction. LivePerson’s AI tools also integrate with a variety of financial services technology to make this easy.