Case Studies

How Frost Bank maintains a 91% CSAT with 24/7 human customer support

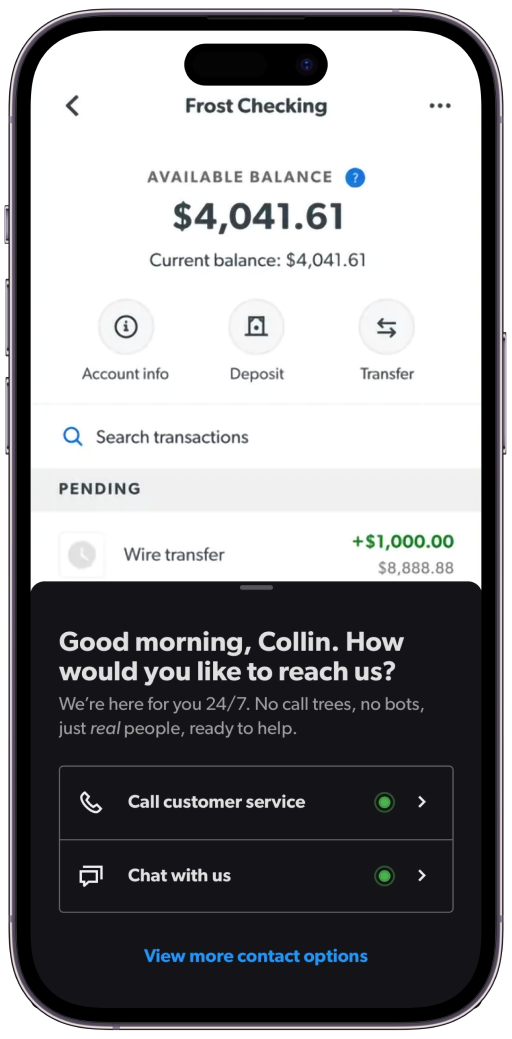

Frost Bank has over 150 years of experience providing financial services to their customers in the state of Texas. So it’s safe to say they know a thing or two about exceptional customer service. Their secret? 24/7 live human support — no phone trees, no bots. Here’s a look at how their partnership with LivePerson and digital experience solutions makes this all possible.

The journey in numbers

91%

CSAT

<60s

first response rate

>70%

of messaging interactions are in the Frost mobile app

>250k

conversations per year

Open the PDF for more details, or keep reading below.

Investing in people

Frost, established in Texas in 1868, has a rich history of building long-term relationships with their customers. Offering banking, insurance, investment, and mortgage services, Frost serves both international and local Texas customers. Their commitment to customers has earned them the #1 ranking for Retail Banking Customer Satisfaction in Texas, according to the J.D. Power 2024 U.S. Retail Banking Customer Satisfaction Study℠ — 15 years running. Without the use of phone trees or bots, this success is largely due to the real people supporting customers each and every day.

“We have a unique approach in our contact center. We don’t use phone trees. We have live 24/7 customer service, local to Texas. We’re here to help people with all their banking needs.”

~ Jacob Coull, Contact Center Product Owner, Frost Bank

Challenge: Putting people at the center of digital transformation and customer interactions

Like many financial institutions, digital experiences have been a focus for Frost for the past few years. However, Frost believes that customers should be able to speak directly to a real person no matter what channel they reach out on. This is how they’ve been managing customer calls for years — without the help of a phone tree. As the team expanded into new digital channels, keeping real people in every conversation was key.

“We want our customers to be able to connect with us the way they want to. Our Millennial and Gen Z customer base continues to grow, and these generations were raised on text messages. Calling is not always the way they want to reach out. Through chat, we can give customers the ability to reach out the way they want to.”

~ Jacob Coull, Contact Center Product Owner, Frost Bank

Solution: LivePerson’s platform and agent workspace

To achieve their digital transformation goals — starting with expanded messaging channels and ways to improve agent productivity — Frost partnered with LivePerson. Focusing on the Connect and Assist phases of the Conversational Flywheel™, Frost transformed their customer experience in the following ways:

Messaging Channels

Recognizing that the younger generations of their customer base wanted more options for connecting, Frost introduced web messaging and in-app messaging. Similar to their phone service, when a customer chooses to chat, they interact with a real person from the start — not an AI chatbot. The introduction of chat has also allowed them to incorporate secure forms, making it safer and easier for customers to share their information and streamline the conversation.

Agent Workspace

Without a bot to collect customer information and route customer inquiries, LivePerson’s Agent Workspace is critical to the success of their agents. In addition to managing customer interactions in the workspace, agents also leverage generative AI tools for agent efficiency like Copilot and KnowledgeAI™. Copilot aids in increasing agent efficiency by summarizing conversations to add to the customer history and suggesting AI-powered answers from KnowledgeAI. Integrations with tools like SharePoint keep KnowledgeAI up-to-date with the latest content and knowledge base articles to inform responses. This makes it easy for agents to provide efficient and personalized customer care.

“Sometimes better customer service is the revenue-generating secret. AI allows us to take our humans and turn them into super humans.”

~ Laura Miller, EVP of Consumer Strategy and Digital, Frost Bank

Results and outcomes

With the help of LivePerson’s Conversational Cloud®, Frost is able to connect with customers through digital-first channels and improve agent productivity with the tools they need to keep up with SLAs and customer expectations. In doing so, the team is able to maintain a 91% customer satisfaction score and keep their response time to under a minute.

“At Frost, we’re passionate about using technology to strengthen human connection. That’s why we’re partnering with LivePerson to integrate AI that empowers our team to demonstrate our culture at scale. We believe innovation that aligns with our values creates experiences that make people’s lives better.”

~ Laura Miller, EVP of Consumer Strategy and Digital, Frost Bank

Digital experience solutions that protect a customer service legacy

Putting people at the forefront of your digital experience might feel like a contradiction, but with LivePerson’s Conversational Cloud, brands like Frost can transform their contact center to empower the people behind it. We believe this is one of the many reasons they were ranked #1 in Customer Satisfaction for Retail Banking in Texas over the past fifteen years. By partnering with LivePerson, Frost is able to keep prioritizing agent productivity and satisfaction for years to come, both in-person and within their digital presence.

Frost received the highest score in Texas in the J.D. Power 2010-2024 U.S. Retail Banking Satisfaction Studies of customers’ satisfaction with their primary bank. Visit jdpower.com/awards for more details.

Want to learn more about the features that helped Frost?

See how agents can deliver relevant experiences more efficiently with LivePerson.