article

The 4 phases of digital transformation in banking

How conversational AI transforms banking experiences

October 29, 2024 • 6 minutes

We don’t need to tell you that the conversations happening in your contact centers produce a gold mine of information that you can use to better understand customer behavior and improve their experience. The more you can leverage and act on the content of these conversations, the better-suited you’ll be to meet customer expectations — and exceed them.

Our research reveals that 73% of consumers are more critical of how businesses interact with them today compared to a year ago. And the stakes rise when it comes to money and how you protect customer data in those sensitive interactions — 94% of business leaders in the banking industry say their customers are more critical of customer engagement than ever.

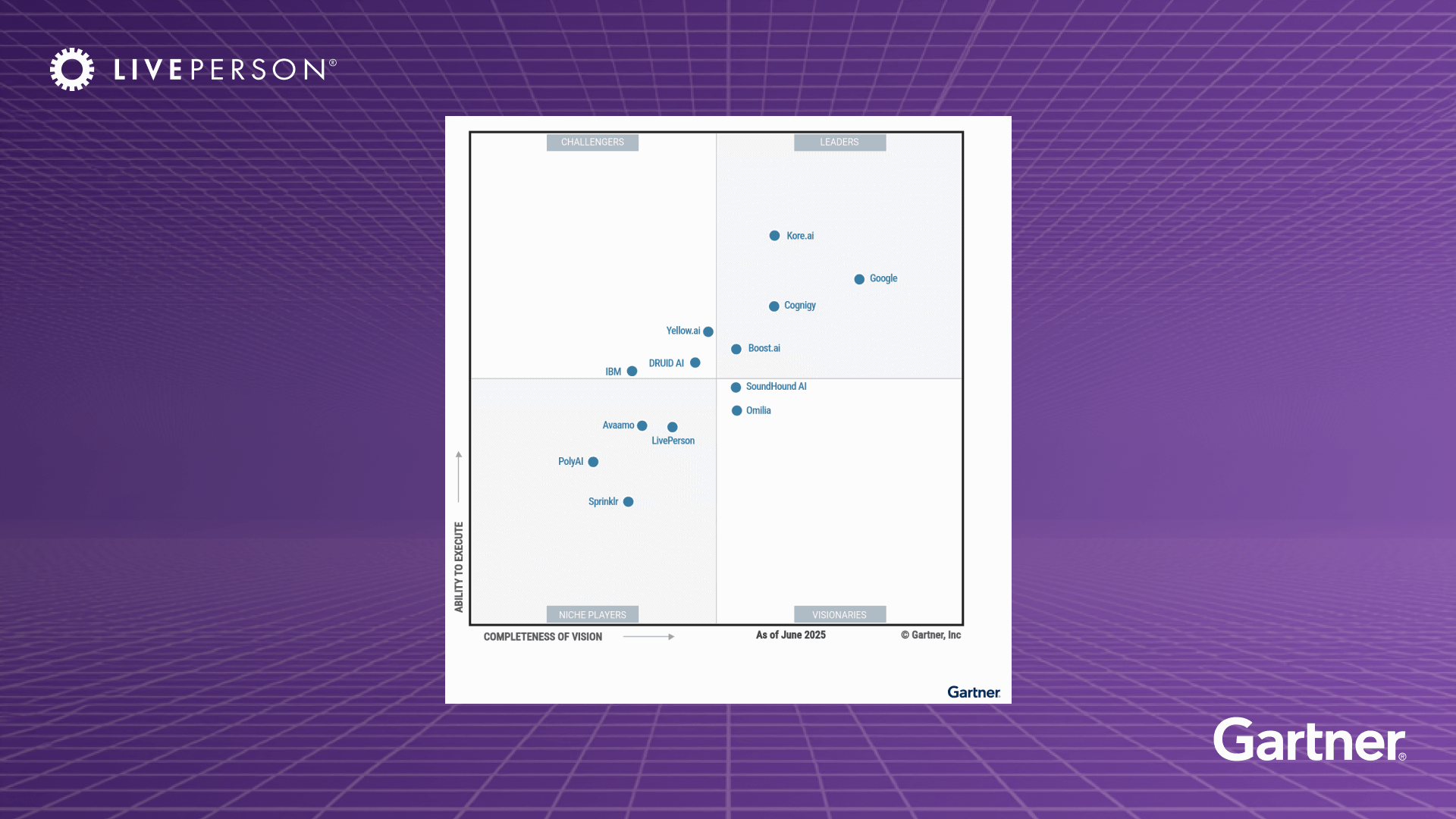

This is why the world’s most innovative financial institutions are putting digital transformation in banking at the core of their customer experience, moving customers off the phone and into the messaging channels they already frequent. They’re also racing to deploy generative AI tools, according to the McKinsey Global Institute, who estimates that “across the global banking sector, gen AI could add between $200 billion and $340 billion in value annually, or 2.8 to 4.7 percent of total industry revenues, largely through increased productivity.” It’s not an overstatement to say that banks have never before had so many tools at their disposal to improve the customer experience.

Adopting digital technologies is a move that benefits everyone and, as part of a bank’s digital transformation, it makes customer conversations far more meaningful and actionable. Let’s take a look at our Conversational Flywheel™, a proven digital transformation strategy framework for driving continuous improvement across your conversational journey. This framework includes four distinct phases for improving customer engagement and operational efficiency.

1. Understand what customers want for the most successful digital transformation in banking

Meeting customer expectations requires that you truly understand customer intent and consider the actual words customers use to speak with you. It’s important to identify this conversation intelligence and act upon issues that customers commonly bring up. Then you can plan your digital innovation around solutions to automate and improve operations while providing more personalized experiences.

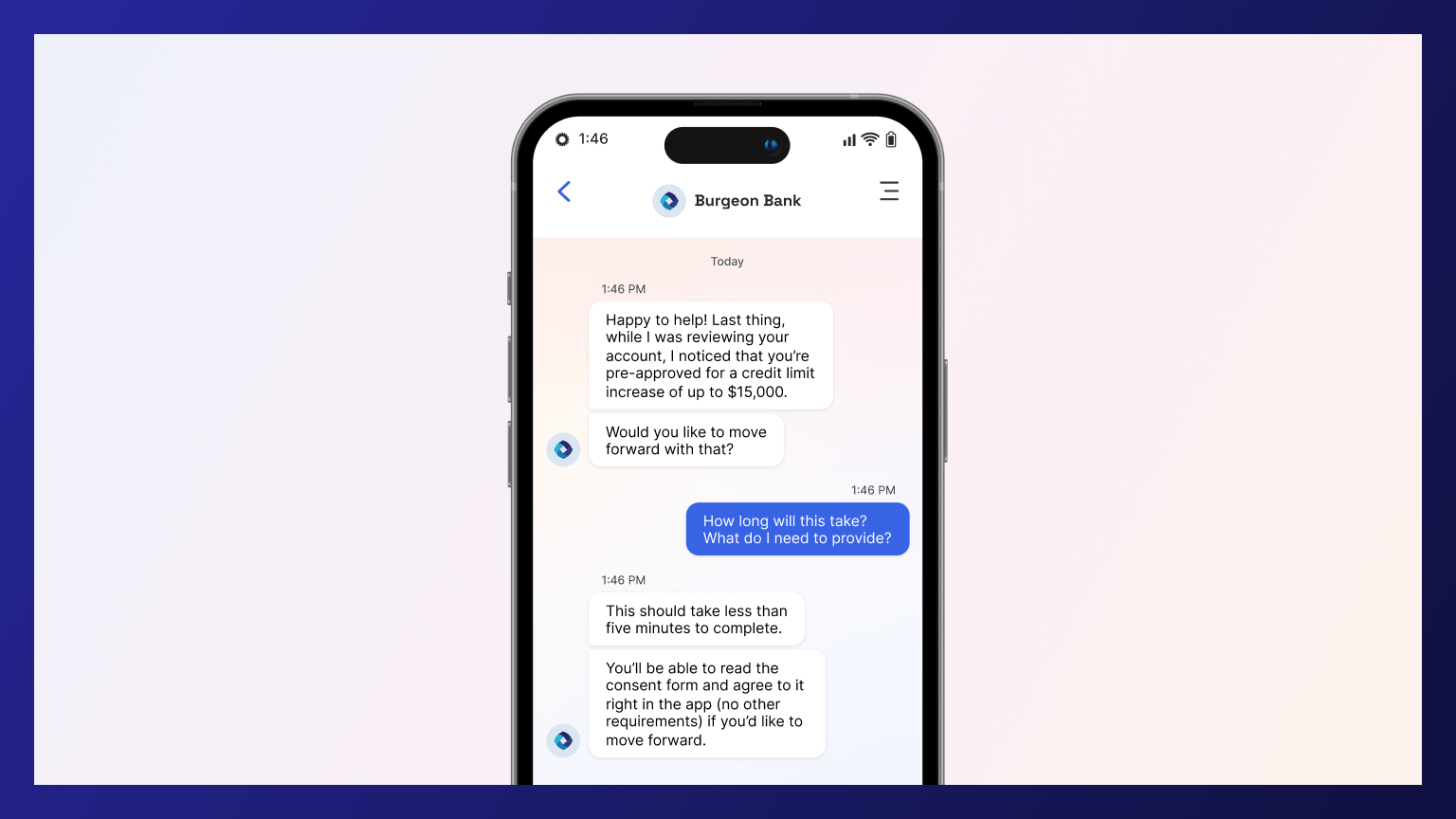

In online and digital banking, questions about withdrawals and deposits topped the list of things customers typically reach out about, accounting for 12.8% of banking industry-related inquiries. This was followed by questions about cards (7.3%) and loans (6.1%). Next in line was account management and funds transfers followed by customer disputes. These types of intents indicate ample opportunity to leverage AI agents to provide more instant customer support for common questions.

2. Connect channels and systems

When customers want to talk to your financial institution, it’s beneficial to move them from expensive-to-operate phone calls to digital channels. This omnichannel messaging approach includes your mobile app, website, SMS, social media platforms, or messaging apps. Our 2024 research reveals that banking sector brands typically engage with customers across an average of five channels.

You can elevate these conversations by integrating your existing customer relationship management (CRM) software, customer data platform (CDP), and telephony systems to create a truly personalized, seamless customer experience. In fact, 76% of consumers want the option to seamlessly switch between calling and messaging, depending on their in-the-moment preferences.

Note: Voice isn’t going away. It just needs to be unified with your other business systems and customer engagement tools for successful digital transformation. Check out how LivePerson can help create this unity with our alternative approach to setting up CCaaS solutions.

3. Assist agents and boost productivity as part of your banking digital transformation

The need for a digital transformation in banking isn’t just to meet customer preferences. It’s also to improve agent experience and performance because they all feed the end result. That’s why our Conversational Flywheel framework touches on how to boost agent efficiency with digital transformation efforts.

Explore the contact center solutions available to provide your team with generative AI solutions that allow them to answer customer inquiries quickly and accurately every time. When agents feel supported, the impact is felt across the customer experience — conversation duration is reduced, agent response time is faster, and customer satisfaction increases.

It’s not surprising that one in two consumers say they’ll consider switching to a competitor if they wait on hold longer than 10 minutes. Yet 25% of banking leaders say that putting customers on hold for more than 10 minutes is acceptable. Clearly, there’s a disconnect here. Empower your agents to provide the best customer experience possible by giving them the tools needed to deliver personalized and efficient conversations every time.

4. Automate for continuous improvement

Support more customers in less time by building safe, compliant AI and automation for the issues that represent top customer intents. Empowering customers to serve themselves sets you up for providing online banking resolutions at scale.

Automation is not just about efficiency; it’s about expanding your customer data collection in leaps and bounds, feeding back into your understanding of customer intent and creating a self-reinforcing cycle that constantly elevates the customer experience. To this end, 70% of LivePerson’s banking industry clients automate 70% of their customer interactions, which is 20% higher than the industry average. Additionally, 54% of banking leaders say they are currently prioritizing messaging with AI over phone calls for customer service.

Case Study: Digital transformation in banking

Frost Bank is a mainstay in Texas, serving its customers for more than 150 years. That longevity is boast-worthy, and it’s not accidental. Frost Bank focuses on providing human, person-to-person support. There are no phone trees or AI chatbots, and yet the bank is no stranger to digital platforms and technology.

In fact, one the keys to Frost Bank’s success is its focus on meeting each generation in the channel they prefer.

“We want our customers to be able to connect with us the way they want to. Our Millennial and Gen Z customer base continues to grow, and these generations were raised on text messages. Calling is not always the way they want to reach out. Through chat, we can give customers the ability to reach out the way they want to.”

~ Jacob Coull, contact center product owner at Frost Bank

The bank uses LivePerson’s platform and agent workspace to improve productivity and meet SLAs. And the team’s response time is impressively less than a minute. Frost Bank also is passionate about “using technology to strengthen human connection,” says Laura Miller, EVP of Consumer Strategy and Digital at Frost Bank. “We believe innovation that aligns with our values creates experiences that make people’s lives better.”

Bank on success

Your conversational banking journey can begin now with LivePerson’s Conversational Cloud® platform that allows you to personalize conversations at each phase of the customer journey. The future of customer service may be conversational AI-powered, but ultimately it’s about the content of the customer conversation that will drive your business forward.