article

Transforming the claims experience: A proven framework for insurance digital transformation

December 06, 2024 • 8 minutes

Insurers are facing increasing pressure to meet rising customer expectations. Consumers want fast, convenient service, and they expect their insurance provider to be responsive across multiple channels whether they need to check policies, file claims, or ask for clarification on their coverage.

And companies that can provide this level of customer experience (CX) are winning.

In fact, McKinsey found that CX leaders outperformed their peers in total shareholder return by 20 percentage points for life insurers and 65 percentage points for P&C insurers.

However, many insurance providers are still relying on outdated contact center business models, leading to long wait times, inconsistent responses, and a lack of personalization.

The top CX problems plaguing insurance companies often stem from these inefficient, manual processes. Agents are overwhelmed with repetitive inquiries, leading to slow response times. Complex policies and procedures can result in inconsistent information being provided, and limited availability on traditional phone lines can leave customers waiting for hours just to get a simple answer. As a result, customer satisfaction drops, and companies struggle to build long-term loyalty.

This is where insurance digital transformation can dramatically improve operations.

By shifting from traditional phone-based service to AI-empowered, digital-first customer conversations, insurers can address these CX problems head-on. From automated self-service for common policy questions, to a variety of helpful digital tools for agents, artificial intelligence helps insurers not only improve efficiency but also create a more personalized, responsive experience for customers.

Bridging the gap: The Conversational Flywheel

To successfully uplevel the customer journey by incorporating conversational AI, LivePerson has designed the Conversational Flywheel™ — a proven digital transformation framework for driving continuous improvement in interactions across every channel.

The flywheel is comprised of four phases for improving customer engagement and operational efficiency:

- Understand

- Connect

- Assist

- Automate

1. Understand the customer data and intents

To truly serve your customers, you must understand their intent — the words and phrases they use when reaching out. In the insurance sector, common intents might include:

- Claims processing and inquiries: Status updates, filing new claims, or questions about coverage.

- Policy management: Changing beneficiaries, adjusting coverage limits, or updating contact information.

- Billing and payments: Clarifying billing statements, making payments, or discussing premium increases.

- Quoting: Requesting quotes from home, life, or auto insurers

- Renewals and cancellations: Inquiries about renewing policies or initiating cancellations.

Accurately capturing customers’ intent allows your agents to provide accurate answers quickly, helps streamline interactions, and improves overall operational efficiency.

This is especially important in the insurance industry where policies, claims, and coverage details can be complicated. Customers need clear guidance on urgent or sensitive matters like filing claims, adjusting coverage, or understanding policy terms.

For example, a customer might ask, “Can I add my spouse to my life insurance policy?” By identifying this as a common inquiry, insurers can build automated workflows that allow customers to update their policies online or receive step-by-step instructions via a chatbot. Not only does this help cut down on wait times and handle times, it also allows agents to focus on tasks that actually require a human touch, like clarifying coverage details or handling sensitive claims.

By identifying the most common intents in your customer interactions, you can streamline insurance operations, reduce costs, and uncover new opportunities for growth.

For example, Najm, a motor vehicle insurer in Saudi Arabia, historically provided customer support through the phone, which resulted in long response times (upwards of two hours) — and increasing customer complaints.

This drove them to undergo a digital transformation in insurance, transitioning from voice-based interactions to LivePerson’s conversational AI chatbots. The new approach empowered their team to support customers with a variety of needs and intents, from opening a claims ticket to submitting information and photos. This is all done through simple conversational automation, and has helped Najm cut contact center costs by 60%.

“Our transition to chatbot models has been a game-changer for customer satisfaction. By leveraging AI-powered chatbots from LivePerson, we’ve not only resolved queries faster but also provided consistent, personalized assistance. Customers appreciate the instant responses and round-the-clock availability, leading to stronger relationships and higher retention rates.”

~ Majed Alhudaib, VP of CX at Najm

2. Connect beyond legacy systems

Today’s insurance customers expect to engage with your brand through the same digital channels they use every day, whether that’s SMS, web chat, social media, or messaging apps like WhatsApp or Facebook Messenger. Companies can even embed messaging into their mobile apps.

But very few insurance industry providers are stepping up to the plate. According to J.D. Power’s 2023 U.S. Claims Digital Experience Study, only 35% of respondents said their insurer is providing a complete digital experience that creates an efficient claims management process, keeps customers informed, and reduces time spent on the phone.

This presents a huge opportunity for insurance providers to differentiate themselves through digital transformation and new business models.

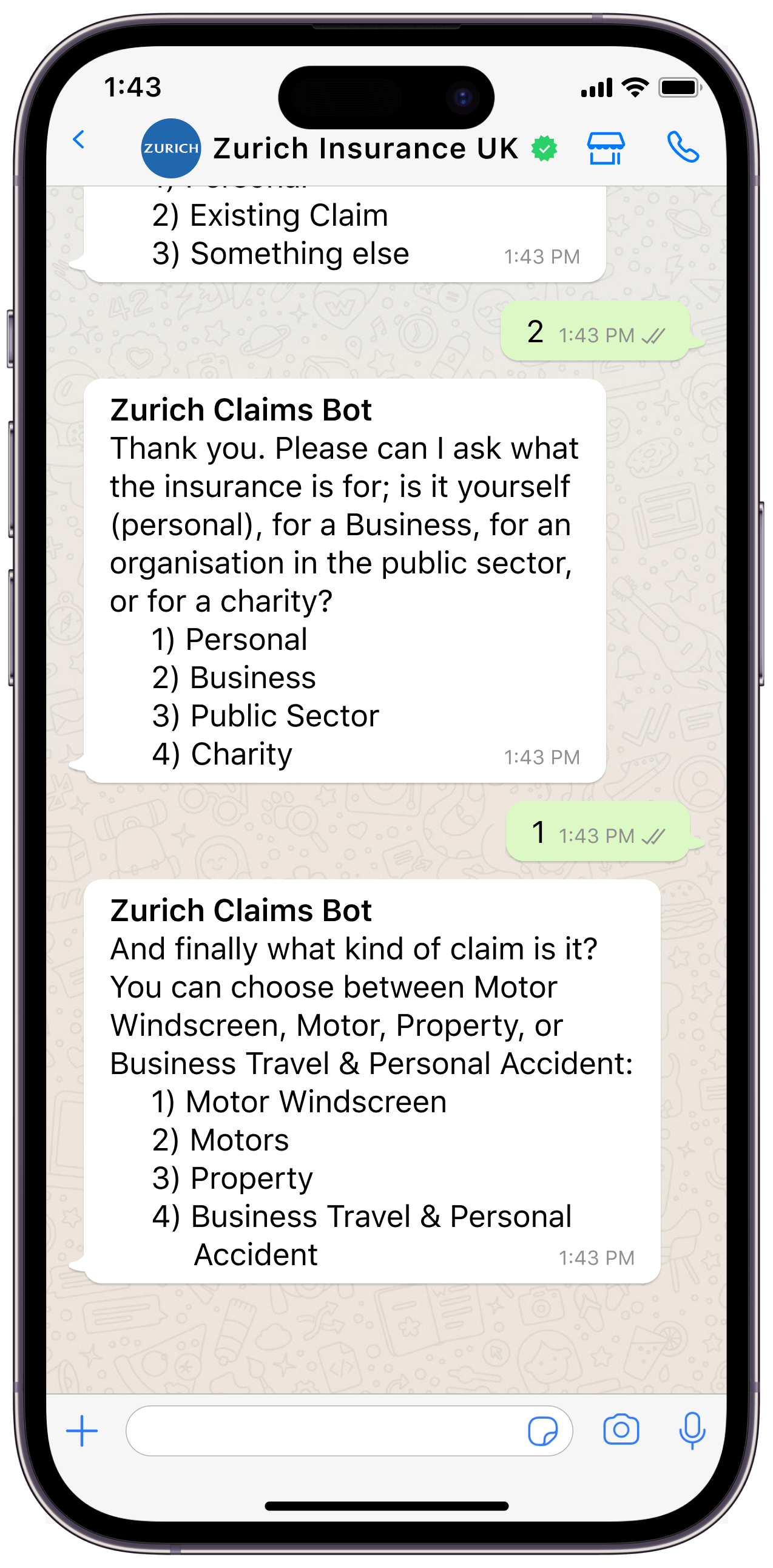

Zurich UK, a leading insurance provider, saw this opportunity and took it by rethinking their CX strategy.

“Historically, email and phone were the only ways to communicate with us,” says Helen Rogers, Head of Claims Digital Experience. “We wanted to give customers more choice and become more digital.”

Using LivePerson’s conversation shifting, a call reduction strategy, Zurich began sending customers to web chat, SMS, and WhatsApp — a well-received change by their customers. Chats saw a 149% increase year-over-year in 2023, with the WhatsApp integration being particularly popular.

Not only does WhatsApp allow customers to see if their messages have been read by the agents, it also supports a full end-to-end messaging journey for claims processing, from filing a claim to uploading documents via the camera app.

The result: Zurich UK has reduced the time it takes to process a claim down to 13 minutes.

3. Assist agents with AI-powered digital technology

At the individual agent level, it’s essential to equip them with the right digital and insurance technology to help every agent provide fast, accurate, and high-quality service — no matter how skilled or seasoned they are.

In an industry where inquiries often involve complex issues — such as interpreting policy details or navigating the stressful claims process — having AI-powered digital tools to help agents in real time can make a significant impact on CX.

Speed is one commonly cited benefit, but besides enabling faster responses, AI tools also improve the accuracy and consistency of agents’ answers, leading to a more cohesive and overall better experience.

For example, an agent handling a call about a life insurance claim might need to provide detailed information about beneficiaries, payout timelines, and required documentation. With an AI agent assist solution like LivePerson’s Conversation Copilot, the agent receives help on several levels:

- First, Copilot Summary equips the agent with a summary of the bot conversation about the initial claim inquiry.

- Then, Copilot Assist provides the agent with LLM-powered recommendations such as relevant policy information or documentation templates to help answer the question correctly — without them needing to manually search through multiple systems.

- Lastly, Copilot Rewrite helps the agent by using generative AI to write and refine a response to the customer.

Tools like these can help agents handle a larger volume of inquiries while ensuring that each interaction is personalized and precise. In busy insurance contact centers, this digital innovation can be crucial for providing a good experience in a scalable and cost-effective way.

4. Automate for more self-service digital experiences

Finally, automation is a game-changer for insurance companies that need to handle routine customer inquiries more efficiently without sacrificing high-quality service.

By automating responses to common customer intents and routine tasks (such as checking policy information, filing claims, or resolving billing issues), insurers can reduce wait times, free up agents for more complex tasks, and offer 24/7 service.

Automation doesn’t just save time either. Like the AI agent assist tools, automating certain conversation flows ensures customers receive accurate responses more consistently and improves both the speed and quality of the service experience.

Consider the high volume of billing-related inquiries an insurance company typically handles. Customers often reach out with questions like, “When is my payment due?” or “Why did my premium increase?” Automating responses through conversational AI chatbots would allow customers to receive immediate answers without having to wait for an agent.

Claim filing is another area that’s ripe for automation. Instead of requiring customers to fill out forms or make a call, insurers can automate claims processes end-to-end through a chatbot.

For instance, a customer involved in a minor car accident could simply start a chat with a bot, describe the incident, upload photos of the damage, and receive guidance on next steps — again, without speaking to an agent. The system could then automatically initiate the claim, check for policy coverage, and provide the customer with an estimated processing time. This not only speeds up claims processing, but also reduces call volumes and improves the CX by providing immediate support.

Legal&Tax, a South Africa-based insurer, wanted to implement an automation strategy that still allowed customers to speak to a human agent when needed.

So, they used LivePerson’s Conversational Cloud® to scope out a flow for an AI business assistant that could automate a variety of processes for clients, from logging claims to purchasing new insurance products.

“Legal&Tax’s implementation of WhatsApp messaging through LivePerson has transformed our customer service, providing seamless transitions between human agents and bot assistance and improving agent efficiency by 3x. LivePerson is a key to our 24/7 customer service success, allowing clients to get help for professional legal, tax, and debt issues with ease and through the conversation medium of their choice — bot or live agent or both.”

~ Darren Cohen, General Manager at Legal&Tax

Power your insurance digital transformation with LivePerson’s Conversational Cloud

The insurance industry is at a pivotal moment where meeting rising customer expectations requires a fundamental shift in how service is delivered. As consumers demand faster, more convenient interactions across multiple channels, insurers have to adapt to stay competitive.

The use of AI-powered tools and digital transformation strategies like the Conversational Flywheel offers a clear path forward, helping insurers create a more responsive and personalized CX.

Get a first-hand look at how providers like Zurich UK and Najm successfully implement these strategies to improve customer satisfaction, streamline operations, and ultimately drive growth in an increasingly competitive insurance landscape.